To know them is to know yourself.

Most know that this famous quote “know thy enemy”, from the book “The Art of War” by the ancient Chinese general Sun Tzu is dated back to several centuries BC, yet even today is considered as one of the most influential works about strategy, not just by military – as it as originally intended – but also political and even business management leaders.

Credits: Kevin Jackson on Unsplash

“Why would such insights on ancient warfare remain relevant to today’s (business) world?”, you might ask. Well, it provides a broad view on strategy, from conflict and battle theories but also about the importance of establishing and nurturing relationships, still valid in the modern world.

For example, the following quote, taken and translated from Sun Tzu’s masterpiece, can easily be applied to today’s business :

“Know thy enemy and know yourself; in a hundred battles, you will never be defeated.

When you are ignorant of the enemy but know yourself,

your chances of winning or losing are equal.

If ignorant both of your enemy and of yourself, you are sure to be defeated in every battle.”

Indeed, this simple observation is at the core of sound decision making – to go to war or do business – and planning the strategies and tactics to implement that decision.

We all agree that competitors are not (necessarily) enemies, or rather “rivals”. However, it is true that a competitor is fighting for the same market, the same customer, the same sale, the same profit as you. In most traditional markets, this competitive battle can be considered as a “zero-sum game”, meaning that one player’s gain is another’s loss. Of course, in new, emerging or fast growing markets there is plenty of growing market space, but in the end it will come down to who plays the market and the customer best, and becomes the leader – or the victor.

Hence, in order not to be defeated in those 100 competitive battles, it is important to know who you’re up against, and how you compare. In other words – those used in the definition of “benchmark” in the Cambridge Dictionary – to measure your business’ performance by comparing it with other things of the same type.

Choose your players

Let’s start with the basics – what is a competitor? According to the Cambridge Dictionary it is a “person, product, company, etc. that is trying to compete with others”, i.e. to try to be more successful than someone or something else. In business language this translates into a

contest or rivalry between brands selling similar products and/or targeting the same consumers, in order to increase sales, revenue and market share.

This definition immediately highlights the fact that competition can be direct (similar product) or indirect (different product but aimed at the same consumer need).

For example, EasyJet as a low-cost airline offers an answer to the consumer need for cheap, mid-range travel, let’s say specifically in France. As such, it is competing on this market directly with other low-cost airlines like RyanAir, Hop, GermanWings, etc… but also indirectly with FlixBus (coach travel), OUI TGV (high-speed train) or even BlaBlaCar (ride sharing), competitors from other industries or sectors.

Credits: Reise Uhu on Unsplash

Different offer, same need – a notion often overlooked yet key to keep in mind when benchmarking, as it looks at competition from the point-of-view of the consumer rather than the traditional approach of direct or frontal competition within the same sector.

Target, aim, shoot !

Now that has been cleared, the real question is : where to start… Well, by identifying and selecting the competitors to include in your benchmark.

Identify –

establish a list of all known competitors, both direct and indirect. If needed, you can classify or rank them according to criteria relevant : size, market, product, image, …

Select –

unless you are facing only a limited number of competitors – in which case you can include all in the benchmark scope – it is recommended to select between 5 and 10 key competitors, ensuring an effective and representative sample. The selection criteria can vary, but should be based on the relevance and importance of each aspect of your competitiveness which you aim to measure and compare. For example, if you want to assess your performance on social media, you can select the competitor brands that are most visible on such media. You can select these criteria from the checklist of benchmark elements developed below.

You might also focus your benchmark on certain competitors because of proximity (in offer, size or location for example), or because they are a reference in your market, or a target you aim for.

Once you’ve selected the benchmark sample, you can start to measure and compare your brand, product or service with your core competitors. Depending on which angle you wish to tackle, you can select all or part of the benchmark items below, building on the 4P of the so-called marketing mix. For each, you can use secondary (using available resources and data like reviews, reports,…) or primary (interviews, focus groups, tests, …) research.

PRODUCT

Since product (or service) is at the heart of your business, this is the best place to start. In the case of direct competitors, you can easily compare product specification & performance. The latter is even more relevant when comparing to indirect competitors, as the performance will reveal which product or service best serves the similar customer.

In the case of our previous example, when comparing EasyJet to another low-cost carrier, one would be looking at specifications like the number of aircraft, leg space, carry-on luggage policy, etc… Relevant performance indicators – both for direct as for indirect competitors – include number of destinations covered, frequency of flights/trips, door-to-door travel time, …

PRICE

Price competitiveness can be assessed on many levels. First, there is the so-called visual price or list price, which is the price generally published in official price lists, brochures, websites – at least for B2C products or services, whereas for B2B prices are rarely disclosed through official listings, more often these are offer-based through formal client-specific quotes, which makes it harder – but not impossible – to assess, for example via prospects or customers, or mystery shopping.

When benchmarking price, it is crucial to compare apple to apple content and hence value. Indeed, a similarly priced product might have different specifications or features. As such, you need to align the specification or features to a comparable level, allocating a standard value to each in order to build a value-adjusted price. This approach is widespread on products like cars where brands can add value – and competitiveness – by adding extra features like navigation, heated seats, … for a similar price.

Finally, pricing benchmarks (visual or value-adjusted) should include promotions, discounts and other conditions. Even if these are often time-bound, they can be quite significant and impact your competitiveness at a given point in time.

In the case of the low-cost airline example, you could compare the visual price for a trip from one city to another on a certain day (travel often applies dynamic pricing, where prices vary depending on the time left before your trip, as to adjust offer to demand), as published on their website.

Adjusting to value would include additional services embedded (or not) in the price, like free drinks or on-board catering, luggage, flexible booking, etc… In the case of indirect competitor benchmark, total time of travel should be included to assess the value behind the list price.

Several specialised websites can do – at least part of – the work for you, like travel websites that list various alternative offers for your trip, similar to insurance comparative websites.

PLACE

Place refers to the way the product or service is delivered to the consumer. In a narrow definition, this relates mainly to the distribution channels, from “brick-and-mortar” shops to online media. However, a wider view would include other steps of the customer journey, covering the full process a prospect goes through when he intends to buy a product or service, as this can reveal a competitive strength in areas important for the customer experience and satisfaction.

Service or network coverage is yet another aspect to assess, as an indicator of accessibility of a given product or service, and the effort needed by the consumer to access. Finally, a distribution benchmark can also evaluate distribution cost, wherever relevant and available.

For a low-cost airline, for example, you could benchmark the user-friendliness of the online ordering system, but also on which platforms (like Trip Advisor, Expedia, Trivago, Booking) consumers can book travel with the competitors – both direct and indirect.

Network coverage in this case would relate to the location of hubs, as well as the number of destinations covered, either directly or indirectly.

PROMOTION

Assuming that competitors are « fighting” for the attention (and the business) of the consumer, communication is another key indicator of any benchmark, as it reveals the relative strengths or weaknesses early in the customer journey.

Start with the communication message, which will reveal how the competitor aims to position itself in the mind of the consumer, and as such which USP (functional or emotional) the competitor believes to own in the eyes of the consumer.

Furthermore, a more down-to-earth analysis of the communication channels (paid, earned or social media) used is a necessary step to evaluate the effectiveness and integration of communication throughout the purchase funnel. Finally, the frequency of communication will provide an indication of the budget spent.

In the example of EasyJet and c°, you can compare the importance of the price in the communication – as this is one of the most important purchase criteria – or if the focus is more on the experience once you’ve reached your destination (quickly and at low cost).

Advertising on expensive media can also be an indication, as such communication cost will be reflected in the price – balancing awareness vs. cost.

PERCEPTION

It is important to look beyond these traditional 4P’s. In today’s business world, perception is everything, the image of a brand or a product can provide a competitive edge. As such, perception is a key – the 5th – element of benchmarking.

The first place to look would be customer reviews (Google, Yelp, …), or even third-party reports (if available) like JD Power, or brand rankings. The availability of such secondary sources will depend on the sector.

You can also find out for yourselves through primary research like surveys (quantitative) or interviews (qualitative), be it internally – how do your employees perceive your competitors – or externally – ask your customers, prospects, suppliers, partners what they think.

PERFORMANCE

Last but not least, you could compare the bottom line performance of your competitors, company and/or brand. Compare sales, sales trends, market share and other indicators like customer base, retention rate, customer satisfaction,… if available in industry or sector databases, for example (access might be subject to a subscription fee).

The benchmark can also include turnover, profits, … and any other aspect which can be relevant to your assessment. There often is a lot of valuable information about the business health, strategy or issues, “hidden” in data that might seem irrelevant at first. Such corporate information can be found in annual (financial) reports, published directly by the competitor, or on business databases (registry of commerce, for example).

Visualise your competition to see how you stand out

As you can see, a competitive benchmark should be done thoroughly, analysing a high quantity of data and information, either readily available, or through first-hand research. The wider and more diverse the information, the more representative and insightful your analysis will be.

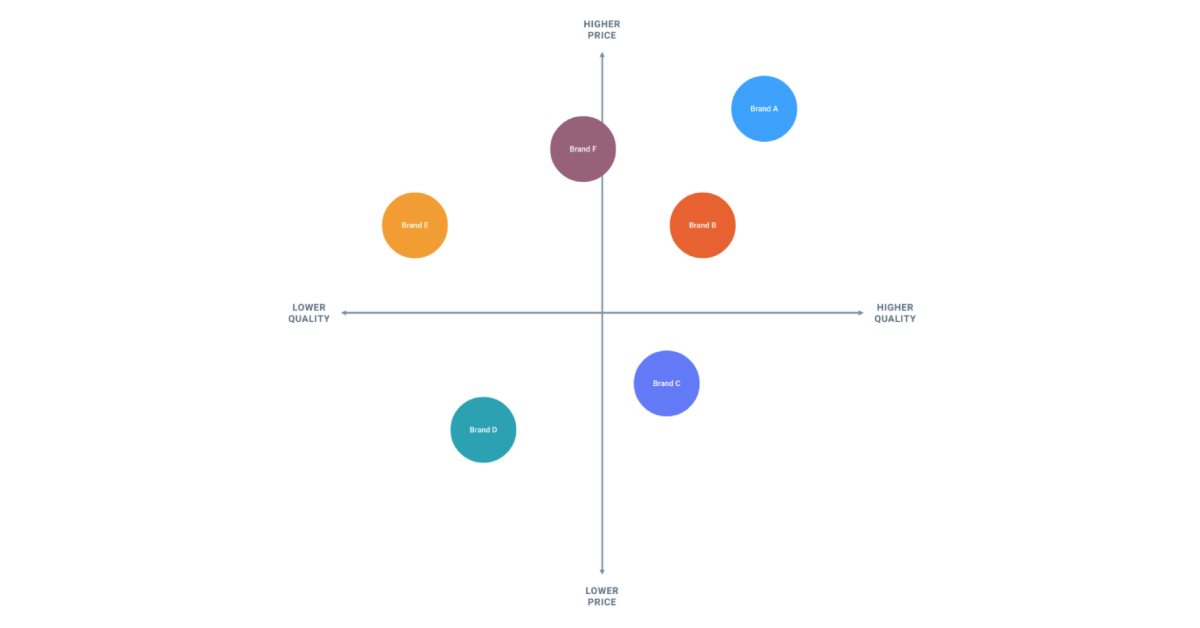

In case you fear to be swamped by the quantity of data, consider visualising wherever possible. I’m talking about pie charts, trend lines, bar graphs of course to represent numerical data and highlight anomalies or tendencies. For more qualitative data like positioning or perception, competitor mapping is usually a very powerful tool, once you’ve determined the axis labels – based on relevant criteria or aspects for your business, product/service or consumer.

Source : https://moqups.com/templates/business-strategy/competitor-analysis/ ©

In the example of low-cost travel, price is the obvious candidate for the axis to position and differentiate the airline brands on. The 2nd axis will depend on the type of analysis. If you want to compare EasyJet to traditional airlines, quality would be a natural element to compare (see below), as the customer would trade off between price and quality.

However, when benchmarking against other low-cost travel providers, the 2nd aspect to embed in the analysis could be the total travel time, which could be considered as a purchase criteria for the consumer when choosing between coach, train or plane.

Source : https://easyjetryanairbrandaudit.wordpress.com/author/lorisangella/ ©

The bigger picture

This competitive benchmark is the next step into assessing your business and building your strategy, which starts by a deep-dive analysis of external factors (PESTEL analysis), followed by a thorough assessment of your (internal) strengths and weaknesses, as well as /external) opportunities and threats (SWOT analysis).

The competitive benchmark allows not only to evaluate relative strengths and weaknesses, it also provides an insight into your competitors’ strategy and as such is a key driver for inspiration and differentiation when defining your strategy. Or, as general Sun Tzu would put it : the simple observation of your rivals is at the core of sound decision making and the planning the strategies and tactics to implement that decision.

Stay tuned to find out more in the next article, where I will explain more about the why, the what and the how of gathering consumer insights. To get more information and key insights about business and brand strategy, check out the Springworks website.